Anyone interested in entering the cannabis industry without any cannabis experience will need the help and expertise of a consultant, whether that be a consulting company, individual, or law firm. Over the years, I have worked with many different consultants in this space – some great and some incompetent. When applying in a cannabis licensing process that is competitive and merit-based, applicants rely on consultants to help them win. This article analyzes the risk factors of choosing the right consultant to help you win a competitive, merit-based cannabis license. The decision to hire a consultant can be a huge risk and impact the success of being awarded a coveted cannabis license. The decision affects the applicant team’s risk of getting the financial payoff of a cannabis license and whether or not the consultant was worth their fees (Pahlke, 2015).

Nicola Batten

Chief Executive Officer

KOLaB Consulting

718 258 7616

I first started helping client’s project manage their application in 2013 in Massachusetts’ in the Nation’s first competitive, merit-based cannabis licensing process for Registered Marijuana Dispensaries (RMD). The application scoring criteria placed a heavy value on the applicant’s cannabis experience. No one in Massachusetts could have cannabis experience, unless it was black-market experience, and those individuals were not keen on having their lucrative business regulated. To fill this gap, consultants from cannabis programs across the U.S. flocked to Massachusetts to provide their cannabis experience from Oregon, Washington, Washington D.C., and especially Colorado.

Over the years, there have been more competitive cannabis application processes in different states and cities. If an applicant needs the assistance of a consultant, how do they decide on the right one? Could they contribute to a winning application? Did their sales pitch and resume convince you to hire them?

Were they good enough?

Massachusetts was the first test of a consultant’s success or failure because of the detailed public disclosure of application records. Over the years, public records of cannabis applications have become rare. Consultants usually boast about their success, but not necessarily specify in which states. If no one knows a consultant’s rate of success or failure, how can you assess their services?

Hiring a consultant may be one of the most important decisions you make when entering a merit-based cannabis business license application. A cost-benefit analysis is usually used for financial analysis to estimate the strengths and weaknesses of alternatives in order to determine the best alternative in terms of benefits provided. We can use this analysis technique to help decide the least risky and best consultant option to hire. A project must meet certain requirements to meet the objective. By managing project risks from the beginning and implementing a formal risk management program, a sound basis for decision making on projects is provided (Fontaine, 2016). Establishing a risk management plan or process from the start can identify the risks involved and use analysis techniques to determine the treatment plans, eventually reducing the severity of a risk to an acceptable level.

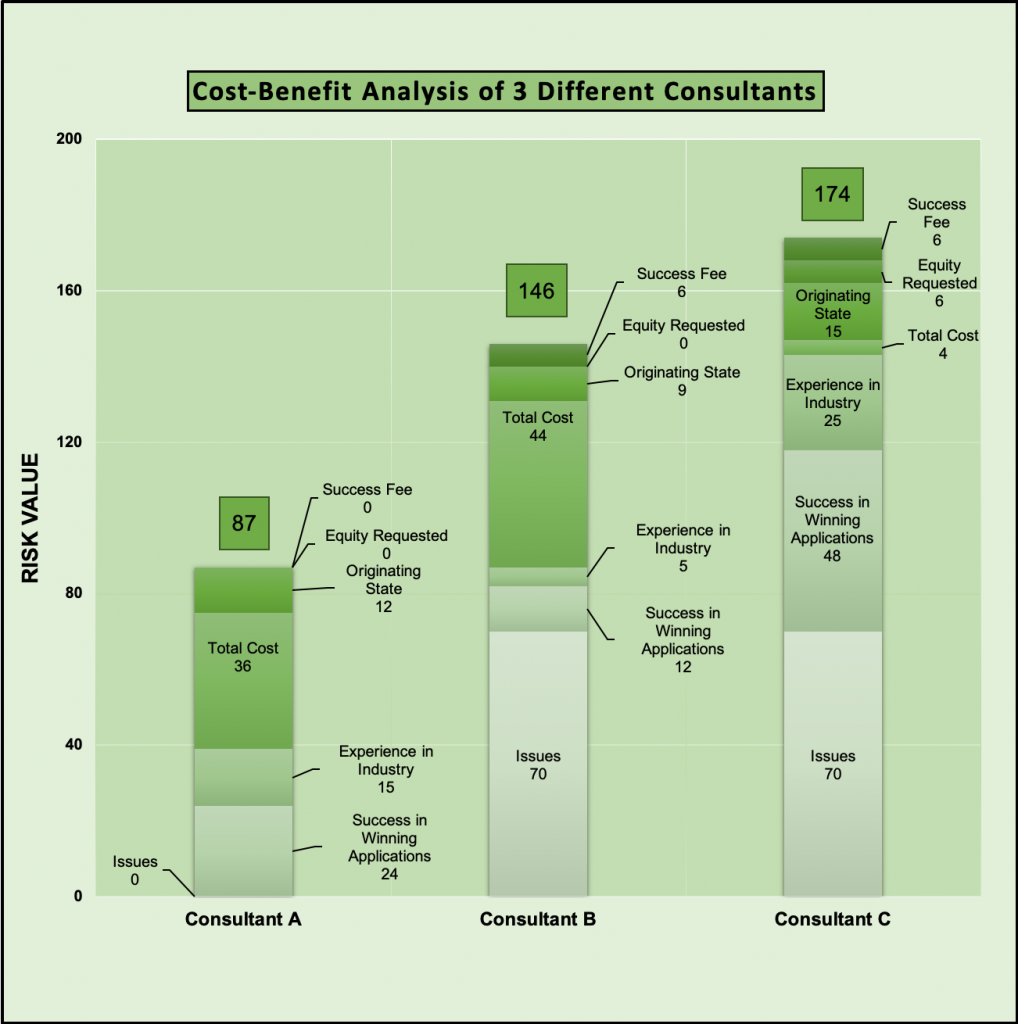

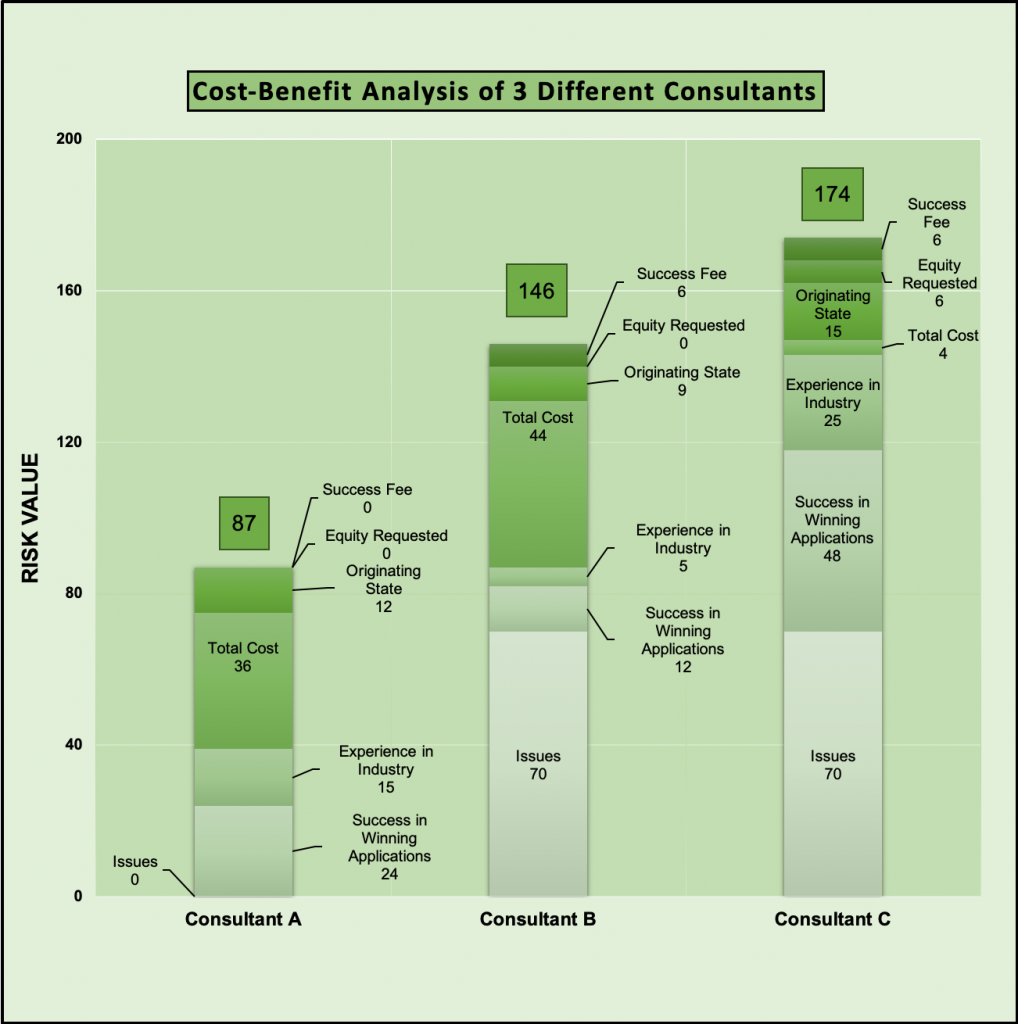

Using a cost-benefit analysis, we’re able to display the risks and benefits of the consultant you’re considering and your alternative options. I’ve used this technique to list risk criteria for choosing a consultant to work with, assigning values to each risk and the severity of the risk. The risk factor value is multiplied the risk severity value to come to a total risk score. A lower total score is the riskiest option and the highest the least risky option. The treatment plan for managing these risks can be mitigated by choosing the least risky consultant or choosing a consultant where the severity of the risk is acceptable. I chose seven risk criteria to evaluate each consultant, emphasizing the impact the risk would have on an evaluator scoring an application.

Consultant has issues: If a consultant has had a criminal conviction, been fined, suspended, or any other negative public information, this factor could disqualify an applicant. The score of having issues is 0, if not, a score of 10. The scores are multiplied by the risk severity value, resulting in a risk score of either 0 or 70.

The consultant’s history of success at winning applications: a critical risk because if they haven’t been through the process or have a history of losing, they probably won’t be successful helping you achieve your objective. The number of states a consultant was successful in is the value, multiplied by the risk severity of 6.

A consultant’s experience in the industry: a crucial aspect in decision making, because the more years they’ve been in the industry, the better they will be at consulting and perceived by evaluators. The number of years a consultant has been in the industry is the value, multiplied by a risk severity of 5.

The total cost of a consultant: this isn’t the most important factor, but if you have a tight budget or you can accept the risk of a high cost, the risk is whether you have paid for a consultant that successfully helped you win a license (which is invaluable) or wasted money on a consultant when you were unsuccessful. I put the costs on a proportionate scale, with the most expensive receiving the lowest score ($1,000,000 is excessive) then multiplied by the risk severity of 4.

The consultants originating state: impacts what the consultant knows about regulatory structures and the perception of evaluators. California used to be viewed as the wild west of cannabis, but in the past years has successfully created a regulated program, but is continuing to implement it. Colorado is perceived as the first state to have a cannabis regulatory framework, which is favorable to evaluators. Michigan was on a home grown, quasi-legal retail sales, patient/caregiver basis, which was largely unregulated. They have since started to implement a regulatory structure, but the patient/caregiver model is still very present. The risk value considered the history and quality of the state’s regulatory structure and multiplied it by a risk severity value of 3.

Success Fee or Equity asked for: a consultant proposing a success fee or equity in your company isn’t a huge risk or a major impact. Consultants will say that having a success fee motivates them to win, but that shouldn’t be their motivation. If a consultant has equity in your company, and you’re successful, their future actions may have consequences to your license. These consequences could have long-term outcomes of a suspension or revocation of your license. If a consultant proposed a success fee or equity, they were given a score of 0, if not a score of 6.

By adding up each consultant’s risk scores, displaying them on a chart, the least risky choice is Consultant C. Consultant C is able to charge such a large fee because they have more experience and success than most other consultants, come from a respected cannabis program, have no issues, and is not requesting a success fee or equity. Consultant C poses the least amount of risk because they are the most likely to help you be successful on a cannabis licensing process.

Another factor that clients are uncertain about when engaging an unknown consultant is the process of gaining trust. A consultant should signal credibility, professionalism, and a positive track record as well as aligning the process to the expectations of the outcome (Nikolova, 2015). This demonstrates the consultant’s ability and integrity in the past, not necessarily giving the client full assurance that they can trust them. When a consultant and client develop an emotional connection, clients believe that the consultant cares for their welfare and reduces risks (Nikolova, 2015). The objective criteria in the chart can be measured, but it is important that your decision to engage a consultant is founded on trust.

With my consultant company, I wish to develop a trusting relationship, because at the end of an application process, I hold all their personal information, secrets, and create the likelihood of winning. I choose clients who are not getting into the industry just to make money (because a lot of times you don’t), but for more benevolent reasons such as starting a new career or the desire to provide cannabis to the people. Using the cost-benefit analysis criteria on myself, I have no issues, I have had more success at helping clients win competitive merit-based cannabis licenses than anyone in the world, I have been working on these processes for over seven years, as a new business, I don’t charge huge sums for my services, I came from Massachusetts and moved to Colorado, and I never ask for a success fee or equity.

Hopefully this analysis tool can help future decision making and reduce the risks associated with the cannabis industry.

References

Fontaine, M. (2016). Chapter 4 – Project risk management. In P.A.J. Green (Ed.),

Enterprise Risk Management: A Common Framework for the Entire Organization. Waltham, MA: Elsevier.

Nikolova, N., Möllering, G., & Reihlen, M. (2015). Trusting as a ‘leap of faith’: Trust-building practices in client-consultant relationships.

Scandinavian Journal of Management, 31(2), 232-245. https://doi.org/10.1016/j.scaman.2014.09.007

Pahlke, J., Strasser, S., & Vieider, F.M. (2015). Responsibility effects in decision making under risk.

Journal of Risk & Uncertainty, 51(2), 125-146. 10.1007/s11166-015-9223-6

By adding up each consultant’s risk scores, displaying them on a chart, the least risky choice is Consultant C. Consultant C is able to charge such a large fee because they have more experience and success than most other consultants, come from a respected cannabis program, have no issues, and is not requesting a success fee or equity. Consultant C poses the least amount of risk because they are the most likely to help you be successful on a cannabis licensing process.

Another factor that clients are uncertain about when engaging an unknown consultant is the process of gaining trust. A consultant should signal credibility, professionalism, and a positive track record as well as aligning the process to the expectations of the outcome (Nikolova, 2015). This demonstrates the consultant’s ability and integrity in the past, not necessarily giving the client full assurance that they can trust them. When a consultant and client develop an emotional connection, clients believe that the consultant cares for their welfare and reduces risks (Nikolova, 2015). The objective criteria in the chart can be measured, but it is important that your decision to engage a consultant is founded on trust.

With my consultant company, I wish to develop a trusting relationship, because at the end of an application process, I hold all their personal information, secrets, and create the likelihood of winning. I choose clients who are not getting into the industry just to make money (because a lot of times you don’t), but for more benevolent reasons such as starting a new career or the desire to provide cannabis to the people. Using the cost-benefit analysis criteria on myself, I have no issues, I have had more success at helping clients win competitive merit-based cannabis licenses than anyone in the world, I have been working on these processes for over seven years, as a new business, I don’t charge huge sums for my services, I came from Massachusetts and moved to Colorado, and I never ask for a success fee or equity.

Hopefully this analysis tool can help future decision making and reduce the risks associated with the cannabis industry.

By adding up each consultant’s risk scores, displaying them on a chart, the least risky choice is Consultant C. Consultant C is able to charge such a large fee because they have more experience and success than most other consultants, come from a respected cannabis program, have no issues, and is not requesting a success fee or equity. Consultant C poses the least amount of risk because they are the most likely to help you be successful on a cannabis licensing process.

Another factor that clients are uncertain about when engaging an unknown consultant is the process of gaining trust. A consultant should signal credibility, professionalism, and a positive track record as well as aligning the process to the expectations of the outcome (Nikolova, 2015). This demonstrates the consultant’s ability and integrity in the past, not necessarily giving the client full assurance that they can trust them. When a consultant and client develop an emotional connection, clients believe that the consultant cares for their welfare and reduces risks (Nikolova, 2015). The objective criteria in the chart can be measured, but it is important that your decision to engage a consultant is founded on trust.

With my consultant company, I wish to develop a trusting relationship, because at the end of an application process, I hold all their personal information, secrets, and create the likelihood of winning. I choose clients who are not getting into the industry just to make money (because a lot of times you don’t), but for more benevolent reasons such as starting a new career or the desire to provide cannabis to the people. Using the cost-benefit analysis criteria on myself, I have no issues, I have had more success at helping clients win competitive merit-based cannabis licenses than anyone in the world, I have been working on these processes for over seven years, as a new business, I don’t charge huge sums for my services, I came from Massachusetts and moved to Colorado, and I never ask for a success fee or equity.

Hopefully this analysis tool can help future decision making and reduce the risks associated with the cannabis industry.