HAS THE GREEN RUSH GONE BUST?

The View from the 50 States and a Glimpse into the International Future

© Douglas Smurr

Mergers and acquisitions in the U.S. cannabis market are taking a major pause compared to last year. Following Tilray’s purchase of Aphria for $2.4 billion in April 2021, came the mega deal of Dublin-based global pharma company Jazz Pharmaceuticals’ acquiring UK based GW Pharmaceuticals in May for $7.2 billion, that was followed by Trulieve’s October $2.3 billion acquisition of Harvest Health and Recreation.

In comparison, 2022 has seen a drastic downturn. The sole notable deal in 2022 has been Cresco Labs’ March acquisition of Columbia Care for $2.1 billion. So why the slowdown? Six endemic stress points are causing the 2022 decline of the cannabis sector.

2021 Cannabis Mergers and Acquisitions by Market Sector

The Economy

FIRST, the uncertainty that has crept into the entire economy is causing the large cannabis companies to jettison underperforming assets before a possible economic correction may render such unattractive entities only worth pennies on the dollar, or simply unmarketable. The current prevailing mindset is to survive — not to grow — by increasing capital reserves to hedge off any overall slowdown to the economy.

Who are the big players? As of August 2022 the 10 largest publically traded cannabis entities according to the latest U.S. Security Exchange Commission or Canadian Securities Administrators filings based on company revenue and income are

Politics

SECOND, Congressional inaction, especially the repeated inability to pass the Secure and Fair Enforcement (SAFE) Banking Act and address the IRS Section 280E disallowance of business deductions continue to hinder growth and access to capital in the cannabis sector. The inability to access banking services and the prohibition of business deductions or credits adversely affects the profitability of cannabis companies.

The House of Representatives Pushes for the SAFE Act:

While the House is focusing on cannabis legislation that is most likely to get to President Biden’s desk, the Senate is signaling once again its desire to pass broad comprehensive cannabis reform over the industry focused banking bill.

Cannabis and the U.S. Banking Industry

Only 6.5% of U.S. banks and 3.5% of Credit Unions service cannabis companies

The present version of the SAFE Banking Act would protect companies providing banking or insurance services to cannabis businesses operating legally pursuant to state law. Currently, no such protections exist. Consequently, only a very limited number of banks or insurance companies operate in the cannabis sector. The lack of access to the banking industry forces many cannabis entities to operate strictly in cash. Not only does this make such companies vulnerable to violent robberies putting customers, employees and the public at risk, it also proves to be an added economic burden forced on these companies as the IRS requires cash intensive businesses to follow strict practices guidelines.

The SAFE Banking Act has passed the House of Representative on seven occasions, however, in the Senate, it has never received a hearing on the Senate floor. Similar to last year, once again the House attached the SAFE Act to the must pass National Defense Authorization Act (NDAA). Last year, the Senate simply stripped the SAFE Act from the final version of the NDAA, and once again this strategy seems destined to the same fate.

In December of 2020, the House of Representatives took a historic step by passing the Marijuana Opportunity, Reinvestment, and Expungement Act (MORE Act) to remove cannabis from the Controlled Substances Act of 1970 (CSA). While the House passed the MORE Act for a second time in April of 2022 to federally legalize cannabis, the Senate wants more.

The Senate Pushes for Legalization and Social Equity:

Unlike the House, the Senate wishes to tackle not only the banking and Section 280E problems by legalizing cannabis at the federal level, it also seeks to pass social equity provisions as well. When Senate Majority Leader Chuck Schumer flanked by Senators Cory Booker and Ron Wyden introduced the Cannabis Administration and Opportunity Act (CAOA) in July, Schumer stated, “The banking bill only deals with a small part of what needs to be done.” Schumer’s statement echoed Booker’s long held instance that comprehensive legalization must be enacted first before more modest reforms like the SAFE Act.

CAOA is a wide-ranging bill that aims to remove cannabis from the CSA, expunge federal nonviolent cannabis–related crimes, undo harms caused by the War on Drugs, prohibit discrimination of federal benefits based on cannabis use, and provides funding for cannabis research.

The Senate sponsors have publicly recognized CAOA will lack sufficient support for passage of their bill and are hoping to pass some type of bipartisan “SAFE Banking Plus” measure sometime between November’s midterm elections and January.

However, after Democrats out maneuvered Senate Minority Leader Mitch McConnell and Republicans by recently passing the Inflation Reduction Act, the chances of gaining bipartisan cooperation to pass such a measure seems extremely unlikely.

And the President’s Desk?

Looming down the street from Capitol Hill however, is an obstacle larger than even the lack of bipartisanship — President Biden’s opposition to legalizing adult-use cannabis.

When the House of Representatives passed the MORE Act to legalize cannabis, President Biden’s former press secretary Jen Psaki failed to specify whether President Biden supported the measure. Revealingly however, she did state “We support the safe use of marijuana for medical purposes,” reinforcing Biden’s long held opposition to legalizing adult-use cannabis.

So unless a miracle compromise reminiscent of the Inflation Reduction Act happens between now and January, count on continued federal inaction rather than witnessing a cannabis measure being signed by President Biden.

State & Local Issues

The lack of federal legalization not only continues to prohibit economies of scale in the cannabis industry as cannabis products cannot cross state boundaries, it also creates a jumbled market that varies not only from state to state, but markedly from one municipality to the next. This disordered playing field is unique to cannabis and is causing multi-state-operators (MSO) to pull out of unfriendly markets.

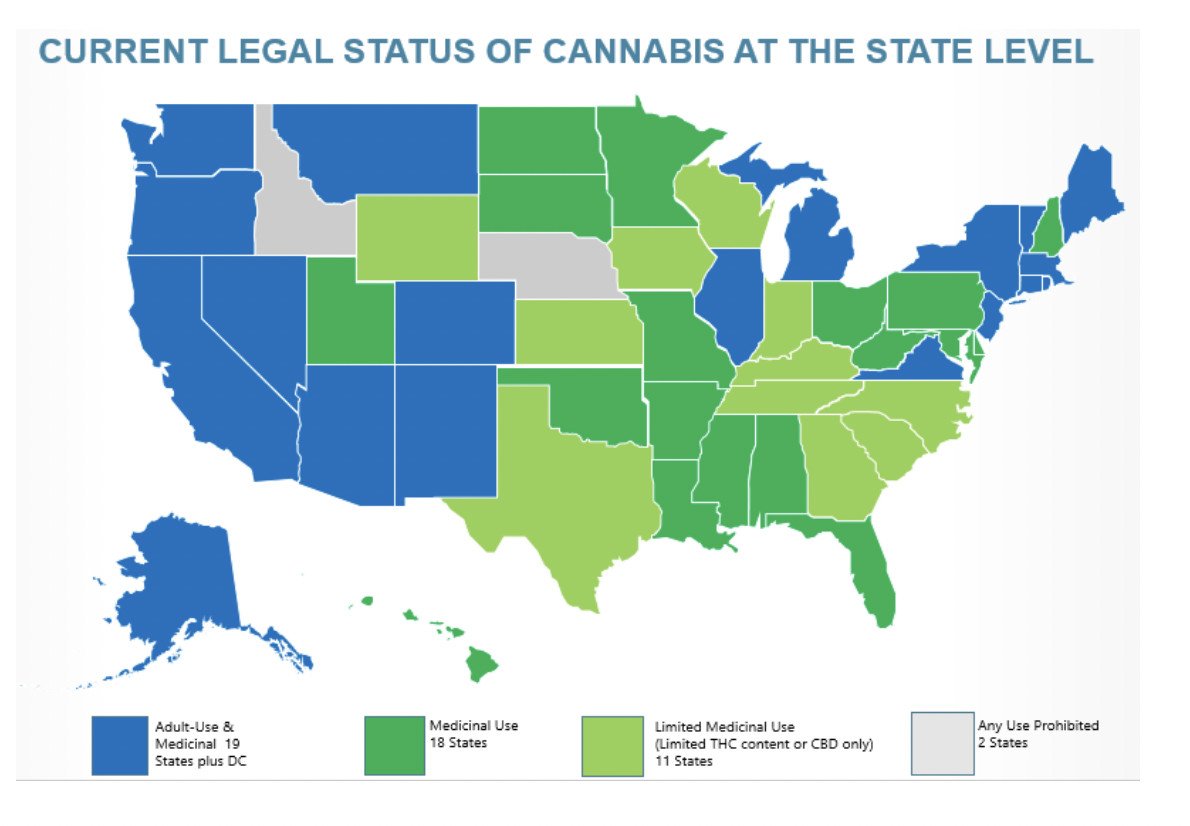

THIRD, state laws and local regulations tend to severely limit and distort supply and demand. Generally, the 48 states that allow some type of cannabis may be divided into two types of states, friendly and unfriendly.

Friendly cannabis states provide cannabis companies with a business friendly environment through a complex mix of political, economic, and regulatory programs. Surprisingly, only a few states fall into this category — Washington, Florida, Alaska, Nevada, Colorado, Arizona, Michigan, and New Jersey are the major contenders for this category.

In true Tolstoian fashion, each unfriendly state proves to be unhappy for cannabis operators in their own peculiar way. Take California, for example. Even though it is home to the largest cannabis market in the nation, it is bogged down by huge operating costs, a high tax rate, numerous restrictive local regulations, and a flourishing black market. All of which are causing MSOs to flee the state.

New York’s problem is just the opposite. A lack of regulation early on created gray areas in the law allowing non-licensed dispensaries to pop up across the state. Additionally, retailers found loopholes allowing cannabis products to be “gifted” to consumers, or allowed them to sell club memberships and gifting cannabis in return. This led to the Office of Cannabis Management issuing numerous cease and desist notices.

In Illinois, its cannabis program has been severely bogged down by lawsuits challenging the application process and taxes that can exceed 40%. While in Mississippi, its medicinal program is in disarray as at least 28 cities and more than a dozen counties completely opted out of its program. The problem is that there is no official list of which local entities opted out of the Mississippi cannabis program because the law failed to include a directive requiring municipalities to report such information.

FOURTH, state and local tax rates make it difficult for cannabis companies to earn profits and stay in business as they compete against the black market. The rates vary greatly by state and also by the type of cannabis product. In many states medicinal cannabis is not taxed, or is subject to only minimal taxes, while adult-use commonly is subject to “sin tax” rates pushing 40% similar to those of tobacco and alcohol.

A prime example is Illinois. To begin, customers face a statewide 6.25% retail sales tax that allows local municipalities to add an additional 3%. Cannabis products containing thirty-five percent or less THC are subject to an additional 10% tax, while products containing more than thirty-five percent THC are subject to a 25% tax. Edibles, infused foods, and beverages are taxed at 20%, while medicinal cannabis is only subject to a 1% tax.

Sitting at the top of the taxing pyramid is California which maintains three separate statewide taxes, a 15% cannabis excise tax, a retail sales tax of 7.25%, and a required local sales tax up to 1%. In addition, local municipalities may charge additional taxes of up to 15%, placing California’s overall cannabis tax bracket in the 23% to 38% range. Washington is close behind with a 37% cannabis excise tax.

FIFTH, when states or localities place restrictions on cannabis licenses, such constraints artificially inflate values of cannabis licenses to astronomical levels — entwining cannabis companies in costly lawsuits to defend or obtain the all-important cannabis license. Where licenses may be worth millions of dollars, it is common for litigation expenses to approach or even exceed the value of the cannabis license.

The Black Market

SIXTH, the consequences of the aforementioned political and state and local issues allows the black market to flourish — cash only transactions combined with excessive taxes and regulations that constrain supply and demand. Today, the effect of the cannabis black market is acute in many jurisdictions. Prior to California legalizing medicinal cannabis in 1996, recall that all U.S. cannabis transactions occurred exclusively as part of an illegal black market.

In States like California, Oregon, and Colorado a large percentage of cannabis sales originate from non-licensed providers. In California alone, the black market is estimated to approach $8 billion dollars in annual sales, or nearly twice the value of legal sales. In fact, in order to survive today in California, dispensaries must have access to a large base of affluent customers willing to pay double to triple the street value of cannabis in exchange for knowing that their transaction is legal and the product is free of harmful pesticides due to strict testing guidelines.

Interestingly, states like Washington and Florida that have implemented cannabis regulations that do not constrain the supply and demand of cannabis, but which operate more closely upon a balanced and unrestrained supply and demand curve do not face such a black market threating its industry.

Conclusion

As for the future, expect these six factors to continue influencing the rise or fall of cannabis mergers and acquisitions. Each factor will play out on its own and will affect the calculation differently.

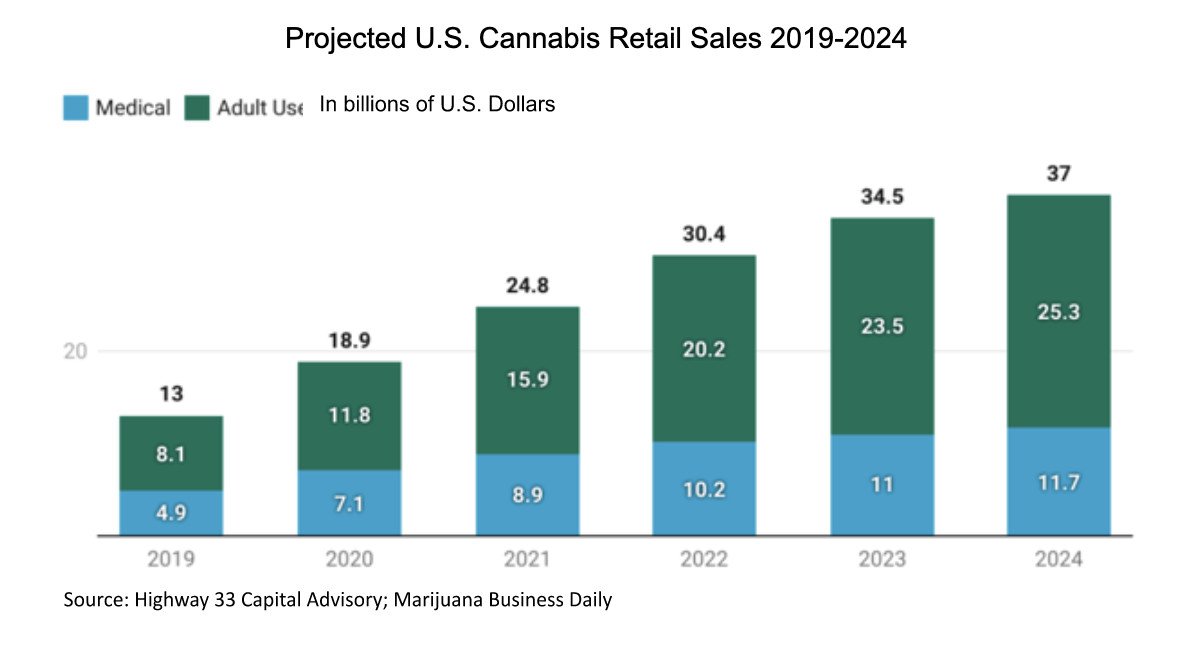

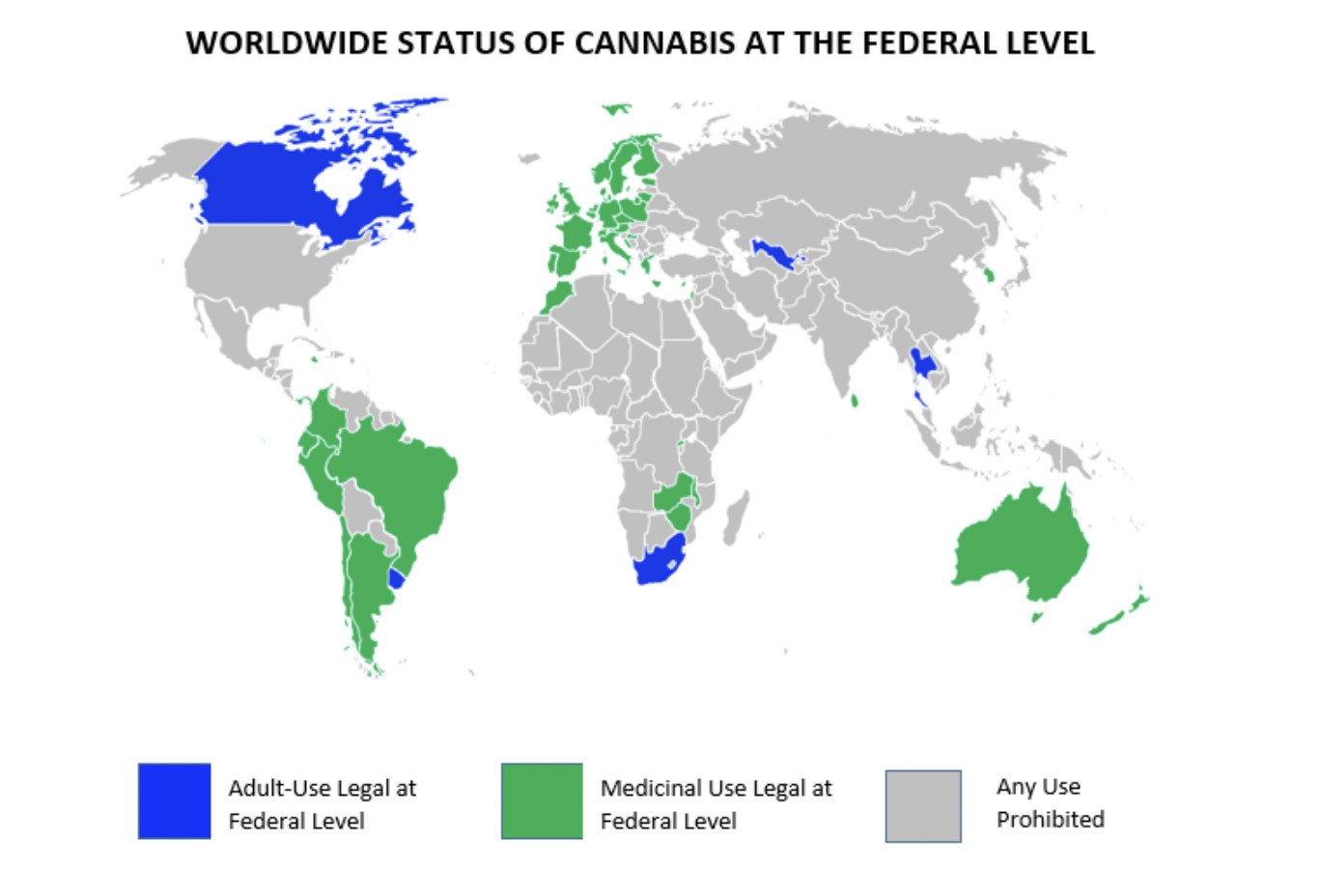

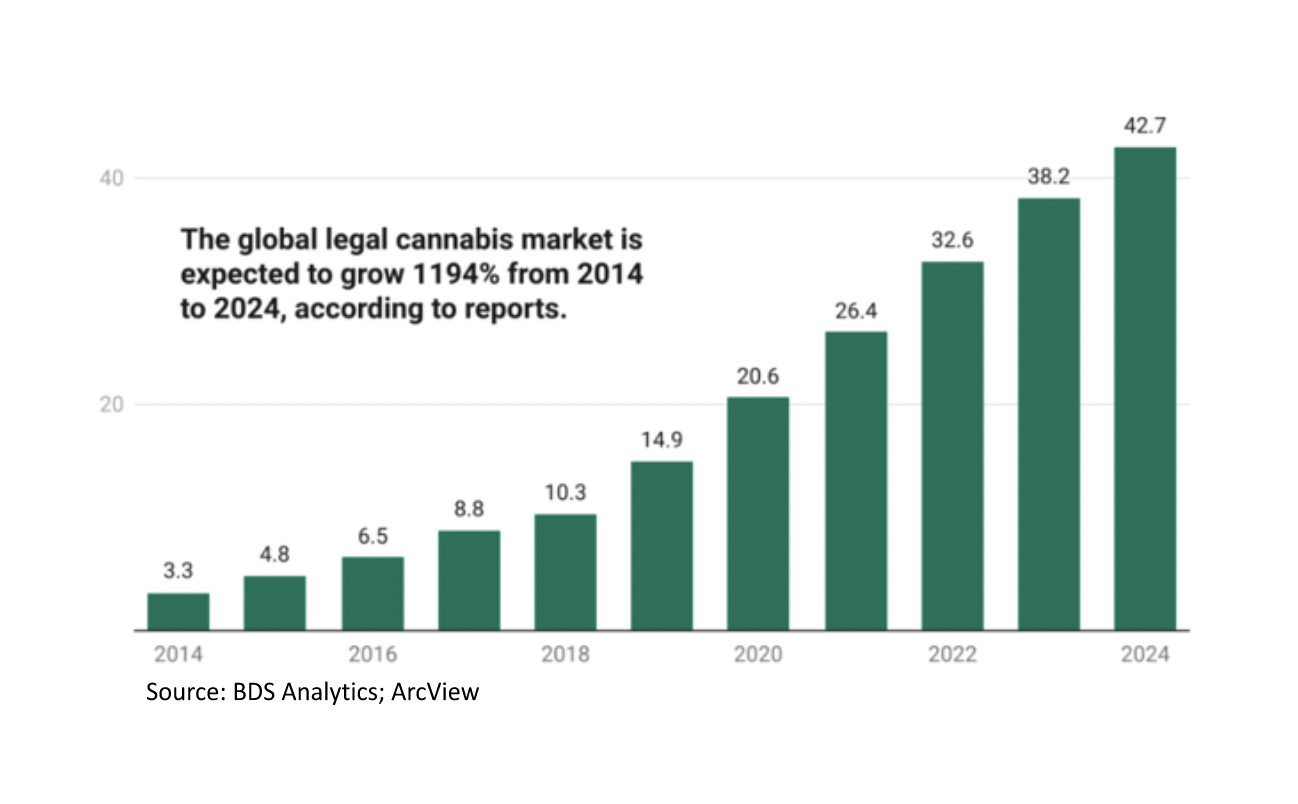

What is certain, is that in the long term, the legal cannabis sector will continue to grow monetarily and geographically. In 2018, Canada legalized cannabis at the federal level.

Eventually, cannabis will become legal at the federal level in the U.S. When this occurs, most likely cannabis also will become a NAFTA/USMCA commodity as Mexico’s Congress is under orders by its Supreme Court to legalize cannabis at the federal level. The European Union, especially in regard to medicinal cannabis, will probably follow — then, a new period will dawn upon the cannabis industry, where cannabis will be legally and freely traded in the international world markets.

Projected Global Cannabis Market Size 2014-2024

About The Author

Douglas Smurr is Of Counsel in the Cannabis, Hemp & CBD; Commercial Litigation; Business Transactions; International; Immigration; White Collar Criminal Defense; and Government Regulatory & Administrative Law practice groups at Gordon & Rees. For over 30 years, he has been a practicing international business attorney maintaining a diverse litigation and transaction practice from offices based in the United States, Latin America, and Europe. Mr. Smurr is a dual national of the United States and Mexico.

As a co-founder of the Cannabis, Hemp & CBD Practice Group, Mr. Smurr has maintained an active cannabis and hemp practice since 2008, representing clients at the municipal, county, state, and court of appeal levels. He currently represents one of the largest cannabis entities in the United States and jointly represents clients in various states in the hemp, CBD, medicinal and adult-use cannabis sectors. His extensive cannabis, hemp and CBD practice covers licensing, regulation, land use and permits, business formation and structuring, mergers and acquisitions, international investment, banking, insurance, compliance with federal and state regulatory agencies, intellectual property, governmental relations, and related state and federal litigation.

Mr. Smurr’s full bio may be found at: https://www.grsm.com/lawyers/d/douglas-p-smurr