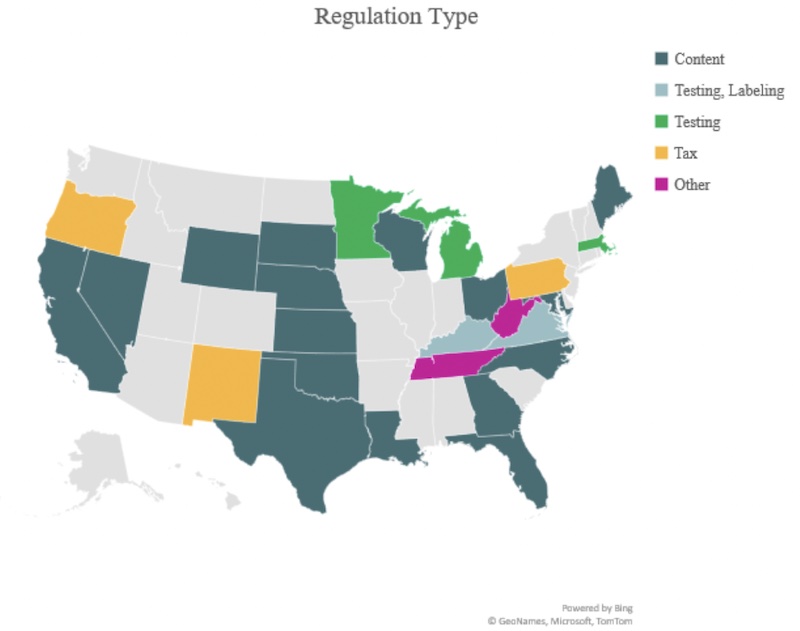

States are deploying a variety of regulatory methods to control the sale and use of Delta-8, with the following methods being the most prevalent.

Content Requirements: In several states, the regulatory compliance for Delta-8 products is only the requirement that a product contain 0.3% THC content in total or less. This is consistent with the federal government’s exemption for hemp as any part of the cannabis sativa plant with no more than 0.3% of THC—anything over that ventures into illegality.

The same content restriction applies in several states, including: California, Florida, Georgia, Iowa, Louisiana, Maine, Maryland, Nebraska, Nevada, North Carolina, Ohio, Oklahoma, South Dakota, Texas, Wisconsin, and Wyoming.

Tax: Imposition of various taxing schemas are also developing across states.

- In New Mexico, Delta-8 is legal, and cannabis is defined to include “every compound, manufacture, salt, derivative, mixture or preparation of the plant, its seeds or its resin…” for the purpose of the Cannabis Tax Act (N.M. Stat. Ann. § 7-42-1), which currently imposes a 12% excise tax on retailers that sell in the state, including those who sell Delta-8.

- In Oregon, Delta-8 is allowed and classified as an “Adult Use Cannabinoid.” Oregon’s Liquor and Cannabis Commission-licensed marijuana retailers are required to charge a retail sales tax of 17 percent for all recreational marijuana—including Delta-8—sold. In some cases, retailers must also charge customers an additional 3 percent for Oregon localities.

- In Pennsylvania, Delta-8 products are legal under the Pennsylvania State Hemp Plan. The Pennsylvania Department of Revenue considers CBD and hemp products as tangible personal property, and thus tax percentages are determined by product type—sometimes subjected to other tobacco products tax depending on the form.

Testing: Typically, states use their Department of Agriculture to conduct testing on Delta-8 products, with language that provides that “[t]he planting, growing, harvesting, possessing, processing or research of industrial hemp as an agricultural product shall be subject to the supervision and approval of the [D]epartment [of Agriculture]” as in Massachusetts. While limitations on THC content, labeling, or taxing usually accompany such requirements, some states have not provided these provisions in their laws regulating Delta-8.

Testing, Labeling: For some, concerns regarding consumer confusion have shaped the regulatory requirements for Delta-8. In those states, labeling requirements exist alongside other compliance requirements.

- In Kentucky, for example, beginning on August 1, 2023, the Cabinet for Health and Family Services will promulgate regulations for the testing of Delta-8 products. In addition, each product manufactured, marketed, sold, or distributed must be packaged and labeled in compliance with the state’s Fair Packaging and Labeling Law.

- In Virginia, a hemp product or industrial hemp extract may contain more than two milligrams of THC if the product or extract contains an amount of cannabidiol that is at least 25 times greater than the amount of THC. Any person that intends to manufacture, sell, or offer for sale a substance intended to be consumed orally that contains an industrial hemp-derived cannabinoid must submit an Edible Hemp Products Disclosure Form. Any edible products that contain THC must be in child-resistant packaging and bear a label with specific information and be accompanied by a certificate of analysis produced by an independent, accredited laboratory. Retailers must have the laboratory’s certificate of accreditation available for review. In addition, these products are subject to packaging, labeling, and testing requirements of the Food and Drink Law that, if are not met, carry civil penalties of up to $10,000.

Other regulatory approaches take an even more comprehensive approach, integrating various approaches to control the manufacturing and sale of Delta-8 products.

- In Tennessee, the legislature established a new, 6% sales tax for the privilege of engaging in the business of selling products containing a hemp-derived cannabinoid that became effective July 1, 2023. This applies in addition to the 7% state sales tax rate. Additionally, the enacted law requires producers and retailers to contract with an accredited third-party laboratory to test products containing a hemp-derived cannabinoid after being manufactured to determine the presence and amounts of cannabinoids, heavy metals, microbials, mycotoxins, pesticides, and residual solvents. The law requires each batch manufactured to undergo testing and obtain a certificate of analysis. Labeling is required to contain various warnings and disclaimers including “an expiration date, a list of ingredients and possible allergens, a nutritional fact panel, the total amount of hemp-derived cannabinoid in the entire package, and a code that can be scanned to access a website providing certain information, including the method of analysis for the testing report required.” As for licensure, the law requires a person in the business of manufacturing or selling products containing a hemp-derived cannabinoid to obtain a license from the Department of Agriculture authorizing the person to engage in that business prior to the commencement of business or by January 1, 2024, whichever is later.

- As of June 9, 2023, West Virginia put forth the Select Plant-Based Derivatives Regulation Act: Industrial Hemp. With a goal to “allow limited, regulated access” to Delta-8, the Commissioner of Agriculture and the Alcohol Beverage Control Commissioner is responsible for effectuating effective regulations “so as to not interfere with the strict regulation of controlled substances” in the state. These regulations require regular sampling and testing to determine purity levels; labeling that includes an explicit warning for children, pregnant individuals, and those on medication; age verification for sales; an 11 percent privilege tax on the retail sales price on each sale of hemp-derived cannabinoids; and a permit process put forth by the Commissioner. Although these regulations impose significant hurdles for retailers, manufacturers, and consumers, they do not ban Delta-8 entirely contrary to some sources.

|

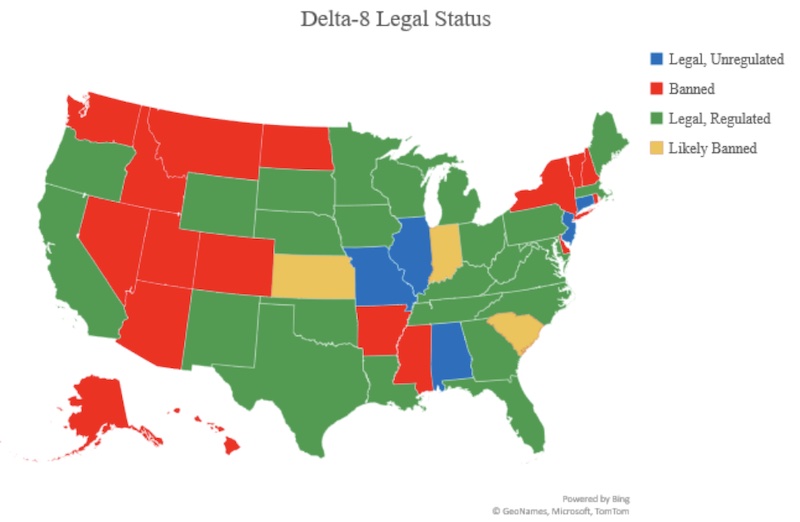

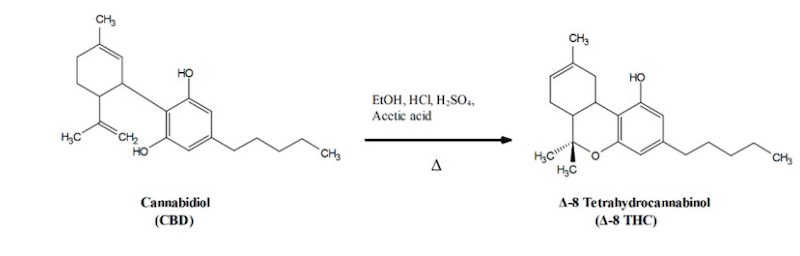

CBD, however, undergoes a conversion process to convert CBD into Delta-8 through a synthetization process. Delta-8 can thus be a natural occurring product, or a synthetic product seized from CBD. While Delta-9 THC has been determined to be the compound responsible for the intoxicating effects of cannabis, although Delta-8 is present in cannabis, it is present only in negligible amounts and in its natural form, cannot cause the same psychoactive effects. This duality has complicated the regulatory status of Delta-8, since the Agriculture Improvement Act of 2018 removed hemp and hemp products containing less than 0.3% Delta-9 THC from the legal definition of marijuana in the Federal Controlled Substances Act. For Delta-8, hemp was defined as including “all derivatives, extracts, cannabinoids, isomers, acids, salts and salts of isomers, whether growing or not.”

Because Delta-8 can be both an isomer of Delta-9 THC and a derivative of CBD when obtained from the cyclization reaction, it may be considered to fall under this definition. On the other hand, there is an argument that the cyclization reaction makes the resultant Delta-8 a synthetic cannabinoid and therefore a controlled substance. Due to this technicality in the definition, Delta-8 has essentially become unregulated at the federal level and often unregulated at the state level. There are increasing concerns about the impurities present in the Delta-8 products sold to consumers due to the lack of regulations, and as states have taken their positions, the legal landscape of Delta-8 and other cannabis derivatives has become a minefield for industry professionals. Moving forward, excise taxation and industry-wide regulation may become a necessary mechanism to aid in the regulation of these products and the protection of the heavily taxed and regulated cannabis industry.

CBD, however, undergoes a conversion process to convert CBD into Delta-8 through a synthetization process. Delta-8 can thus be a natural occurring product, or a synthetic product seized from CBD. While Delta-9 THC has been determined to be the compound responsible for the intoxicating effects of cannabis, although Delta-8 is present in cannabis, it is present only in negligible amounts and in its natural form, cannot cause the same psychoactive effects. This duality has complicated the regulatory status of Delta-8, since the Agriculture Improvement Act of 2018 removed hemp and hemp products containing less than 0.3% Delta-9 THC from the legal definition of marijuana in the Federal Controlled Substances Act. For Delta-8, hemp was defined as including “all derivatives, extracts, cannabinoids, isomers, acids, salts and salts of isomers, whether growing or not.”

Because Delta-8 can be both an isomer of Delta-9 THC and a derivative of CBD when obtained from the cyclization reaction, it may be considered to fall under this definition. On the other hand, there is an argument that the cyclization reaction makes the resultant Delta-8 a synthetic cannabinoid and therefore a controlled substance. Due to this technicality in the definition, Delta-8 has essentially become unregulated at the federal level and often unregulated at the state level. There are increasing concerns about the impurities present in the Delta-8 products sold to consumers due to the lack of regulations, and as states have taken their positions, the legal landscape of Delta-8 and other cannabis derivatives has become a minefield for industry professionals. Moving forward, excise taxation and industry-wide regulation may become a necessary mechanism to aid in the regulation of these products and the protection of the heavily taxed and regulated cannabis industry.